Now I'm a tax and spend person. I believe that Government at all levels should tax and spend. What I mean by tax and spend is Government should determine what services it needs and wants to provide and at what service level and then tax accordingly. If our politicians don't like the level of tax then they go back to what services they want to provide. I know Government finances are more complicated than this simple principle, yet if Government and Council follow this simple principle we get the price of services and can decide what we want to be taxed.

Council Tax is the local tax for local services. In Cambridgeshire most of the money goes to the County Council, with some going to District and some going to the Town and Parish Councils.

Use of reserves is one of the biggest problems that distorts the Council Tax rates. Because it gives the impression that services are being paid for out of Council Tax and by using reserves to keep Council Tax down this gives a false impression of services costing less than they actually do.

The problem is compounded because of inflation.

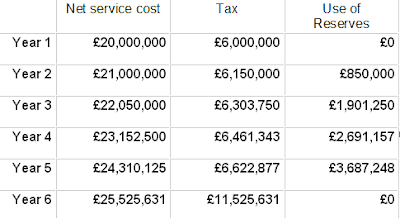

Below is a simple example of using reserves to keep the cost of council tax down. In this example a £1,000,000 of reserves are used with a 10% increase in the net cost of services and Council Tax is kept at zero increase.

In Year 6 reserves have run out and the options are to either raise Council Tax by 50% or cut £500,000 from the net cost of services.

In the next example the amount of increase is 2.5% in the net cost of services and 2.5% increase in the Council Tax. This example assumes no increase in Government Grant or charges the Council can make which makes up the £14,000,000 difference between the Net service cost and Tax.

So having spent £3,588,600 in reserves, in Year 6 there is a deficit of £1,839,715. To make this up Council tax would have to rise by 30% in Year 6 to make up this deficit.

In the next example the Net Cost of Services rises by 5% and the Council Tax increases by 2.5%. As in the previous example Government grants and service charges have a zero increase.

The deficit in Year 6 is £4,737,182. This added to the Council Tax would mean a 69.7% rise on top of the 2.5% annual rise. Either the Council Tax goes up by 69.7% or the Net service cost has to be cut £4,737,182.

Over just 4 years the amount of Reserves spent is £9,129,655.

I know there are many other factors in the actual calculations with Government grants which do go up but are currently reducing. I know charges haven't been included, but charging for services is a double edged sword as pushing up charges can mean a loss of revenue as people may not be willing to pay higher charges. But this isn't the point of these examples. What I'm trying to show is using reserves to keep Council Tax down by using reserves is false and is wrong. The cost of services are not reflected in the amount of Council Tax increases and there comes a time when either Council Tax has to rise or services are cut and the same amount of Council Tax has to be paid.

Both the Town Council and the District Council have kept Council Tax down by using reserves. Under the Liberal Democrats, the Town Council eventually ran out of reserves and had to cut projects to maintain a low Council Tax rise. The same goes for HDC which had the problem of using reserves to keep services going in its "socialist utopia". The deficit caused by low tax/high services is being slowly dealt with by cuts. What HDC needed to decide is whether it wants to be a high tax/high services council or a low tax/low services council. I feel they have decided to be neither.

In the coming budget round it will be interesting to see what the Town and District Councils will do with the spending pressures they are accumulating. The capping regime has gone and authorities can put up their portions that make up the Council Tax by whatever they like so long as it is approved by a referendum. The Zero Council Tax bribe by George Osbourne is also going to cause problems as this too makes a problem for the future as I does exactly what using reserves does. It will give a false impression on what the Council Tax rate should be. Also it HDC get £200,000 in extra grant this year without this money next year it will mean a greater rise in Council Tax or more cuts.

Tuesday, November 15, 2011

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment