I wish you all a very Merry Christmas and a Happy and Prosperous New Year.

Monday, December 19, 2011

Why is the Town council paying for CCTV?

I don't understand why the Town Council feels it should contribute to the District Council owned CCTV system. The first item was to find out is where the CCTV cameras in St Neots are located. HDC provided me with the following information.

1. A map:

2. There locations:

Most of these are public spaces. The yellow ones are covering District owned car parks. One covers the skateboard park on the District owned Riverside Park.

Only one of these 13 CCTV cameras covers Town Council land and that is Shady Walk. So why are we paying for these cameras? Basically because the owners (HDC) is running out of money and rather than close the system they get there Town Council to pay up half the costs for St Neots.

There is a case for doing this. The Town Council wants the CCTV system to continue. It helps the keep the Town Centre secure plus catch criminals and anti-social behaviour.

The arguments against the Town Council paying for CCTV are also numerous:

1. These CCTV concentrate only on the Town Centre. So the people of Eynesbury, Eaton Socon and many other parts of St Neots are paying for a service which doesn't cover them.

2. St Neots Town Centre is used by many residents from outside St Neots for shopping and services. Yet these don't pay for this service via their Town/Parish Councils. Only via HDC Council Tax which St Neots residents also pay.

3. Quite a few of these CCTV cameras are on District Council land and cover District Council run Car Parks. The District Council derives an income from these car parks. The Town Council doesn't.

4. HDC owns these cameras and should pay for the whole cost rather than taxing the Council taxpayer via the Town Council.

Whilst I could dream up some more but those arguments will do.

These CCTV cameras are owned and run by HDC. They are there for all residents of HDC and not specific residents who use the Town Centre. They protect HDC assets and yet St Neots is being taxed by stealth to pay for these cameras.

I say as HDC owns these cameras and many of the locations they cover then HDC should pay for them and tax all residents for this privilege. Why should all St Neots Council taxpayers pay extra for these cameras? Only to keep the District Council tax down and the St Neots Council tax higher than it should be!

1. A map:

2. There locations:

Most of these are public spaces. The yellow ones are covering District owned car parks. One covers the skateboard park on the District owned Riverside Park.

Only one of these 13 CCTV cameras covers Town Council land and that is Shady Walk. So why are we paying for these cameras? Basically because the owners (HDC) is running out of money and rather than close the system they get there Town Council to pay up half the costs for St Neots.

There is a case for doing this. The Town Council wants the CCTV system to continue. It helps the keep the Town Centre secure plus catch criminals and anti-social behaviour.

The arguments against the Town Council paying for CCTV are also numerous:

1. These CCTV concentrate only on the Town Centre. So the people of Eynesbury, Eaton Socon and many other parts of St Neots are paying for a service which doesn't cover them.

2. St Neots Town Centre is used by many residents from outside St Neots for shopping and services. Yet these don't pay for this service via their Town/Parish Councils. Only via HDC Council Tax which St Neots residents also pay.

3. Quite a few of these CCTV cameras are on District Council land and cover District Council run Car Parks. The District Council derives an income from these car parks. The Town Council doesn't.

4. HDC owns these cameras and should pay for the whole cost rather than taxing the Council taxpayer via the Town Council.

Whilst I could dream up some more but those arguments will do.

These CCTV cameras are owned and run by HDC. They are there for all residents of HDC and not specific residents who use the Town Centre. They protect HDC assets and yet St Neots is being taxed by stealth to pay for these cameras.

I say as HDC owns these cameras and many of the locations they cover then HDC should pay for them and tax all residents for this privilege. Why should all St Neots Council taxpayers pay extra for these cameras? Only to keep the District Council tax down and the St Neots Council tax higher than it should be!

Labels:

CCTV,

Conservatives,

HDC,

SNTC

Thursday, December 15, 2011

Does HDC believe the External Auditors are DAFT?

In an HDC report on the so far uncompleted annual accounts the following is said:

HDC says the Auditor's report is DAFT!

Labels:

Conservatives,

HDC

Wednesday, December 14, 2011

HDC Accounts not now ready until the New Year!

The Corporate Governance Panel seems to have given up on agreeing the annual accounts which were due on 30th September 2011. In a recent report the CGP says:

The Panel was informed of efforts made by the Head of Financial Services’ staff and the Council’s external auditors to complete the process for finalising and publishing the Council’s accounts for 2010/11. Members are hopeful that the work will be finalised early in the New Year.

No date or extra meeting arranged.

In a previous blog I set out an explanation sent to me by Steve Couper of HDC. In it he said:

.... and the current intention is to submit them to the next programmed meeting of the Panel on the 7 December.

Even this date has been missed.

What has been dropped is any target date. Just "early in the New Year". Whatever that really means.

The law is very clear:

(3) Subject to paragraph (4), a larger relevant body must, no later than 30th September in the year immediately following the end of the year to which the statement relates—

(a)consider either by way of a committee or by the members meeting as a whole the statement of accounts;

(b)following that consideration, approve the statement of accounts by a resolution of that committee or meeting;

(c)following approval, ensure that the statement of accounts is signed and dated by the person presiding at the committee or meeting at which that approval was given; and

(d)publish (which must include publication on the body’s website), the statement of accounts together with any certificate, opinion, or report issued, given or made by the auditor under section 9 (general report) of the 1998 Act.

(4) The responsible financial officer must re-certify the presentation of the statement of accounts before the relevant body approves it.

To me this is straight forward. The Corporate Governance Panel cannot delegate these powers away to Council Officers. Yet that is what it seems to have done. HDC does like Breaking the Law.

Labels:

Breaking the Law,

Conservatives,

HDC

Tuesday, December 13, 2011

HDC Planning decides for the cinema!

The reason why I'm interested in this application has to do with the District and Town Councils owning the land on which this cinema complex is to be built. I'm not normally interested in general planing applications but follow those for publicly owned land. I also look at the Useless Planning Committee of the Town Council to show how useless it really is.

The Cinema is due up for decision on 19th December 2011. The 20MB planning report is here. The original Development Brief is here.

Reading the planning report I was first struck by one paragraph.

The proposals certainly differ from the Development Brief. The access from Huntingdon Street was supposed to be a minor entrance with the main entrance from Lidl Car Park.

Access from Huntingdon Street.

This is what the Development Brief says:

The "broad principle" here is the main entrance is from the Lidl car park. I cannot see how having sole vehicular entrance from Huntingdon Street is a "broad principle". The "broad principle" in this context is for a two entrance car park. If the car park entrance had been moved to round the back of Lidl then, I feel, this "broad principle" would be acceptable. No second entrance then the use of the term "broad principle" is very wide indeed. I believe this is totally meaningless.

The provision of a larger scale building (neighbour amenity)

The size of the building is also important. I have never seen how a 7 screen cinema as originally envisaged could fit into the area in the Development Brief.

This is a very strong double headed arrow which gives the impression that HDC Planning takes Neighbour Amenity seriously. Taking Neighbour Amenity into account this was the final drawing on the Development Brief.

Taking into account the Broad Principle of Neighbour Amenity, this means the potential larger scale building is restricted in where it can go. This is clearly set out in the picture above. The Double headed arrows clearly set out the clearance needed to protect Neighbour Amenity.

Whether or not the development is within the "broad principles" is open to debate. Protecting Neighbour Amenity has been trashed. Protecting Green Open Spaces has also been trashed. HDC, along with the Town Council are owners of this land. If Development Briefs are to mean anything then they must be adhered to by the owners - both Councils - who should tell the developers to adhere to the Development Brief or they won't sell or lease the land.

The planning department and HDC shouldn't get away with their "broad principles" argument. This is being used selectively to cover up the obvious real differences between the Development Plan and the Planning Application. In the drive to get a cinema, at any cost, HDC has gone to the public with a consultation which maps out a scenario. Then, in secret, it has trashed its own Development Plan. As the larger building is larger than the boundaries drawn then HDC should have gone back to the public with an amended Development Plan. That would have been democratic and inclusive. Instead the public has been kept in the dark.

The "Broad Principles" mean:

Important Building Frontage has gone.

A much larger building than mapped out.

More "Open Green Space" taken than the Conservatives "We will protect Open Green Spaces" envisaged.

Neighbour Amenity, as mapped out, trashed.

Lidl car park entrance not being used.

The message from HDC is loud and clear. In Planning terms HDC can do what it likes with its land. The people are of no real concern. St Neots must have a cinema has been the cry. Right from the start I have blogged that a cinema wouldn't fit into the area outlined. Right from the start I have said HDC will have to trash the Development Brief to get this cinema through. HDC owns the land where the cinema is going. Whether as owner or planning authority should have done the decent thing and be honest with the local residents over what is coming. Instead HDC hides behind "broad principles".

In the end this devalues anything said by HDC over Planning. Any "Development Brief" is really not worth the consultation and time wasted in producing this document. Why waste time and effort on "development briefs" when HDc can simply ignore them anyway.

The Cinema is due up for decision on 19th December 2011. The 20MB planning report is here. The original Development Brief is here.

Reading the planning report I was first struck by one paragraph.

The proposals certainly differ from the Development Brief. The access from Huntingdon Street was supposed to be a minor entrance with the main entrance from Lidl Car Park.

Access from Huntingdon Street.

This is what the Development Brief says:

What is shown is this is a minor access and not the only access. This was to be the service access.

The much bigger arrow shows the main access will be from via the Lidl car park.The "broad principle" here is the main entrance is from the Lidl car park. I cannot see how having sole vehicular entrance from Huntingdon Street is a "broad principle". The "broad principle" in this context is for a two entrance car park. If the car park entrance had been moved to round the back of Lidl then, I feel, this "broad principle" would be acceptable. No second entrance then the use of the term "broad principle" is very wide indeed. I believe this is totally meaningless.

The provision of a larger scale building (neighbour amenity)

The size of the building is also important. I have never seen how a 7 screen cinema as originally envisaged could fit into the area in the Development Brief.

This is a very strong double headed arrow which gives the impression that HDC Planning takes Neighbour Amenity seriously. Taking Neighbour Amenity into account this was the final drawing on the Development Brief.

Taking into account the Broad Principle of Neighbour Amenity, this means the potential larger scale building is restricted in where it can go. This is clearly set out in the picture above. The Double headed arrows clearly set out the clearance needed to protect Neighbour Amenity.

The first sentence of paragraph 7.5 says: "The Development Brief makes it clear that it is intended to guide development with indicative concepts, rather than provide a prescribed layout."

That statement I can agree with. It is here to give guidance to the developer and land owners (District and Town Councils) on what the site can be used for. The double headed arrow for "protecting neighbour amenity" as the Planners inform the public has been shot to pieces. Even in broad terms the principle of "protecting neighbour amenity" has been trashed.

The cinema is much larger than the "potential larger scale building here" as indicated in the picture above.

Whether or not the development is within the "broad principles" is open to debate. Protecting Neighbour Amenity has been trashed. Protecting Green Open Spaces has also been trashed. HDC, along with the Town Council are owners of this land. If Development Briefs are to mean anything then they must be adhered to by the owners - both Councils - who should tell the developers to adhere to the Development Brief or they won't sell or lease the land.

The planning department and HDC shouldn't get away with their "broad principles" argument. This is being used selectively to cover up the obvious real differences between the Development Plan and the Planning Application. In the drive to get a cinema, at any cost, HDC has gone to the public with a consultation which maps out a scenario. Then, in secret, it has trashed its own Development Plan. As the larger building is larger than the boundaries drawn then HDC should have gone back to the public with an amended Development Plan. That would have been democratic and inclusive. Instead the public has been kept in the dark.

The "Broad Principles" mean:

Important Building Frontage has gone.

A much larger building than mapped out.

More "Open Green Space" taken than the Conservatives "We will protect Open Green Spaces" envisaged.

Neighbour Amenity, as mapped out, trashed.

Lidl car park entrance not being used.

The message from HDC is loud and clear. In Planning terms HDC can do what it likes with its land. The people are of no real concern. St Neots must have a cinema has been the cry. Right from the start I have blogged that a cinema wouldn't fit into the area outlined. Right from the start I have said HDC will have to trash the Development Brief to get this cinema through. HDC owns the land where the cinema is going. Whether as owner or planning authority should have done the decent thing and be honest with the local residents over what is coming. Instead HDC hides behind "broad principles".

In the end this devalues anything said by HDC over Planning. Any "Development Brief" is really not worth the consultation and time wasted in producing this document. Why waste time and effort on "development briefs" when HDc can simply ignore them anyway.

Monday, December 12, 2011

St Neots pays "Stealth Taxes"

The Town council budget for 2012/13 brought one point to the fore. That is the amount of money the Town Council is now contributing because of HDC cuts. Lets remember that by ending a service and getting the Town Council to pick up the cost doesn't mean those costs go away for the Council taxpayer. Just they are charged by a different Council. In this case it is the Town Council.

In the 2012/13 budget the cost of HDC cuts are adding to the budget. The 2 public conveniences are costing £34,000. CCTV cameras (Town Council paying half the costs) £22,750. The Town Centre Initiative is costing an extra £10,000. This adds up to £66,750 or £6.17 per Band D Council taxpayer.

I feel I can argue that as SNTC has made provision to operate the toilets at South Street, the £15,000 allocated to run and maintain this facility should also be added to this list. This would make £81,750 a year that SNTC is paying for services formally run by HDC. This is essentially a Conservative Stealth Tax on the St Neots Council Taxpayer of £7.55 per Band D Council taxpayer.

It can be argued the Town Council has taken over these services. Yet when HDC made some of these cuts it was boasting at keeping their rise to 2.5%. In truth the Town Council is taxing us to provide these services. If these services weren't to be run by the Town Council but by the HDC this would save the Band D council taxpayer £7.55 a year.

The problems HDC face has been with them for coming up for a decade. Now, under the cover of coalition cuts, HDC is cutting.

In the 2012/13 budget the cost of HDC cuts are adding to the budget. The 2 public conveniences are costing £34,000. CCTV cameras (Town Council paying half the costs) £22,750. The Town Centre Initiative is costing an extra £10,000. This adds up to £66,750 or £6.17 per Band D Council taxpayer.

I feel I can argue that as SNTC has made provision to operate the toilets at South Street, the £15,000 allocated to run and maintain this facility should also be added to this list. This would make £81,750 a year that SNTC is paying for services formally run by HDC. This is essentially a Conservative Stealth Tax on the St Neots Council Taxpayer of £7.55 per Band D Council taxpayer.

It can be argued the Town Council has taken over these services. Yet when HDC made some of these cuts it was boasting at keeping their rise to 2.5%. In truth the Town Council is taxing us to provide these services. If these services weren't to be run by the Town Council but by the HDC this would save the Band D council taxpayer £7.55 a year.

The problems HDC face has been with them for coming up for a decade. Now, under the cover of coalition cuts, HDC is cutting.

Labels:

Conservatives,

HDC,

SNTC

Saturday, December 10, 2011

HDC hates the notion of a referendum

In an act of mutual self interest HDC group leaders have put forward a motion to the next Council Meeting on 14th December 2011. This calls for low tax rate councils to be allowed higher increases and high taxing councils to be restricted to lower increases. For information the Government has set the ceiling for Council Tax increases at 3.5%. If greater then a referendum is needed.

But this motion is wrong. The Coalition Government has ended capping and allowing each Council to decide the rate of Council Tax itself with a referenda for the electorates. If HDC feels it has a good case to increase their portion of the Council Tax then HDC should put this to the public by way of a referendum.

Instead HDC group leaders, by putting this motion forward, are trying to wriggle out of a referendum by allowing higher increases for low taxing authorities. This is wrong. All authorities should be looking to communicate with there residents over what the Council wants to spend and the tax rate to achieve that spending. If the residents don't want to be taxed so highly then service cuts will happen.

In Cllr Abelwhite's letter to the DCLG he states:

There is an argument that referendums may penalise low taxing and low spending authorities for

previous good financial performance. With referendums and re-billing having significant costs, the

benefits of holding referendums are more attractive for authorities with higher Council Tax as the

percentage increase would generate greater receipts for them and make it easier for them to fund

the additional costs.

But HDC isn't a low taxing/low spending authority. It has for a long time been a low tax/high spend council which spent reserves to prop up the failing budget. It is not for HDC to compare with other District Councils tax levels. It is for HDC to decide its spending levels and tax accordingly.

In Cllr Downes email he states the following:

A 3% increase in Council Tax would net £292,800 in extra tax. The current estimate is £100,000 for carrying out a referendum. But that is a one-off and could be used from reserves to pay for this. But that is the question. Do the HDC political parties actually want to give the residents the right to vote over excessive increases or carry on the same? The answer seems to be carry on the same.

A referendum would give a big headache to the political parties as they would have to campaign for an increase. The likelihood of getting enough people out to campaign for an increase is minimal. Likely there would be a revolt in there own ranks to any increase.

I hope Eric Pickles stays the course and dismisses this way round the rules. What is the point of giving this power to the people when those in charge just want to get around the rules.

Excessive Council Tax rises must mean a referendum. In my view the 3.5% level is itself excessive and should be 2.5% or less. If HDC wants to increase the tax it should go for a big rise and the political parties should campaign for an increase. If they don't want to campaign for an increase then they should cut services and cost accordingly.

But this motion is wrong. The Coalition Government has ended capping and allowing each Council to decide the rate of Council Tax itself with a referenda for the electorates. If HDC feels it has a good case to increase their portion of the Council Tax then HDC should put this to the public by way of a referendum.

Instead HDC group leaders, by putting this motion forward, are trying to wriggle out of a referendum by allowing higher increases for low taxing authorities. This is wrong. All authorities should be looking to communicate with there residents over what the Council wants to spend and the tax rate to achieve that spending. If the residents don't want to be taxed so highly then service cuts will happen.

In Cllr Abelwhite's letter to the DCLG he states:

There is an argument that referendums may penalise low taxing and low spending authorities for

previous good financial performance. With referendums and re-billing having significant costs, the

benefits of holding referendums are more attractive for authorities with higher Council Tax as the

percentage increase would generate greater receipts for them and make it easier for them to fund

the additional costs.

But HDC isn't a low taxing/low spending authority. It has for a long time been a low tax/high spend council which spent reserves to prop up the failing budget. It is not for HDC to compare with other District Councils tax levels. It is for HDC to decide its spending levels and tax accordingly.

In Cllr Downes email he states the following:

A 3% increase in Council Tax would net £292,800 in extra tax. The current estimate is £100,000 for carrying out a referendum. But that is a one-off and could be used from reserves to pay for this. But that is the question. Do the HDC political parties actually want to give the residents the right to vote over excessive increases or carry on the same? The answer seems to be carry on the same.

A referendum would give a big headache to the political parties as they would have to campaign for an increase. The likelihood of getting enough people out to campaign for an increase is minimal. Likely there would be a revolt in there own ranks to any increase.

I hope Eric Pickles stays the course and dismisses this way round the rules. What is the point of giving this power to the people when those in charge just want to get around the rules.

Excessive Council Tax rises must mean a referendum. In my view the 3.5% level is itself excessive and should be 2.5% or less. If HDC wants to increase the tax it should go for a big rise and the political parties should campaign for an increase. If they don't want to campaign for an increase then they should cut services and cost accordingly.

Labels:

Conservatives,

Council Tax referendum,

HDC,

Liberal Democrats

Thursday, December 8, 2011

A message from a reader

I received the following comment via the private messaging facility on the St Neots Community Forums. As such the sender shall remain anonymous. It looks as though it is written by a Town Councillor but I cannot be sure.

I notice in your blog you make much of HDC changing its tune over the South Street toilets. Have you ever considered asking some questions rather than jumping to conclusions. snrednek say: Yes I ask questions all the time. Answers there are few. SNTC have managed to convince HDC to let us reopen and run these toilets because its good for the town to do so. Unlike the old council we dont go public in bitching about HDC, we work in a mature manner to do the right things for the town, and make a good case for things to happen. It would be nice if you could follow this story of yours up with "SNTC do something good for the town, at no extra cost to the tax payer".

Hmm....No extra cost to the Council Taxpayer! That sounds good. But whilst the Council Taxpayers aren't paying any more they could be paying less. And the £55,000 allocated contains within £15,000 for the first year running costs which aren't accounted for in future budgets.

snrednek says: Where I find any Council doing a good job I say so. Each Council has its own website. The Conservatives have their own website. The St Neots Conservatives had their own website and now its gone. The Councils and Political Parties get there views over in the two local newspapers without too many awkward questions. Political Parties can put out leaflets, but rarely do so, during the year. I try and ask the awkward questions. When HDC closed the South Street Toilets one of the reasons given was they were inappropriate for the conservation area. Now they are to be re-opened this means the inappropriate reason was a lie.

In the end these are my views on issues affecting St Neots. If you wish to promote differing views, free resources are out there for you to do so.

I notice in your blog you make much of HDC changing its tune over the South Street toilets. Have you ever considered asking some questions rather than jumping to conclusions. snrednek say: Yes I ask questions all the time. Answers there are few. SNTC have managed to convince HDC to let us reopen and run these toilets because its good for the town to do so. Unlike the old council we dont go public in bitching about HDC, we work in a mature manner to do the right things for the town, and make a good case for things to happen. It would be nice if you could follow this story of yours up with "SNTC do something good for the town, at no extra cost to the tax payer".

Hmm....No extra cost to the Council Taxpayer! That sounds good. But whilst the Council Taxpayers aren't paying any more they could be paying less. And the £55,000 allocated contains within £15,000 for the first year running costs which aren't accounted for in future budgets.

snrednek says: Where I find any Council doing a good job I say so. Each Council has its own website. The Conservatives have their own website. The St Neots Conservatives had their own website and now its gone. The Councils and Political Parties get there views over in the two local newspapers without too many awkward questions. Political Parties can put out leaflets, but rarely do so, during the year. I try and ask the awkward questions. When HDC closed the South Street Toilets one of the reasons given was they were inappropriate for the conservation area. Now they are to be re-opened this means the inappropriate reason was a lie.

In the end these are my views on issues affecting St Neots. If you wish to promote differing views, free resources are out there for you to do so.

Labels:

snrednek

Monday, December 5, 2011

What the Coalition Agreement says on Council Tax freezes

The Coalition Agreement says:

We will freeze Council Tax in England for at least one year, and seek to freeze it for a further year, in partnership with local authorities.

So all authorities have the same information. So it shouldn't have come as a surprise, as it seems to have done, that the Coalition has announced money for a second year of funding for a freeze. Yet this seems to be the case.

On the other hand how has DCLG worked in partnership to ensure this freeze can go ahead? I cannot find evidence to back up any notion of partnership.

Lets get back to the Councils. The Town Council isn't in receipt of Government grants so is unaffected by the grants cuts. HDC finances are in such bad shape that they need the Council Tax rise to maintain a semblance of providing services.

HDC was happy to throw £millions at keeping services going. These reserves are running out. HDC has still to decide whether it is a it is a low tax/low spending authority or not. The rhetoric seems to be HDC wants a higher Council Tax rate, but is trying to find ways around the referendum needed to increase their portion of the Council Tax. Yet if services are to be maintained there needs to be a substantial Council Tax rise.

CCC has yet to decide whether they

The District Councillors need to get it into their heads there needs to be cuts.

We will freeze Council Tax in England for at least one year, and seek to freeze it for a further year, in partnership with local authorities.

So all authorities have the same information. So it shouldn't have come as a surprise, as it seems to have done, that the Coalition has announced money for a second year of funding for a freeze. Yet this seems to be the case.

On the other hand how has DCLG worked in partnership to ensure this freeze can go ahead? I cannot find evidence to back up any notion of partnership.

Lets get back to the Councils. The Town Council isn't in receipt of Government grants so is unaffected by the grants cuts. HDC finances are in such bad shape that they need the Council Tax rise to maintain a semblance of providing services.

HDC was happy to throw £millions at keeping services going. These reserves are running out. HDC has still to decide whether it is a it is a low tax/low spending authority or not. The rhetoric seems to be HDC wants a higher Council Tax rate, but is trying to find ways around the referendum needed to increase their portion of the Council Tax. Yet if services are to be maintained there needs to be a substantial Council Tax rise.

CCC has yet to decide whether they

The District Councillors need to get it into their heads there needs to be cuts.

Labels:

Conservatives,

HDC

HDC still racing to get its accounts approved

The accounts must be approved by 30th September of each year. This year HDC has missed the deadline and has done so by a wide margin. The accounts and annexes are down as "To Follow".

In the report from the Auditors to the Council the following is said about the delay:

We therefore propose to include a report be exception following our vfm conclusion for 2010/11 to confirm that we have identified significant weaknesses in the Council’s arrangements for ensuring reliable and timely financial reporting that meets the needs of internal users, stakeholders and local people, as a result of the delay.

The report goes into detail:

However, the authority was not able to provide us with a comprehensive set of supporting working papers at the start of our audit. There are a number of reasons for this including:

An interesting bit:

Leisure Centres

Our review of leases identified that the five leisure centres included on the Council’s balance sheet are held under management agreements. These agreements indicate that the assets are jointly controlled assets between the Council and Cambridgeshire County Council. The Council has prepared an assessment of the proportion of the assets attributable to the County Council based on capital investment in the assets since they were built. At the date of writing this report management were still in the process of making the necessary adjustments to the financial statements.

Initial calculations expect this to impact the cost of the assets on the balance sheet by decreasing their value by approximately £1.5 million - £2 million (£19.8 million total assets).

From the Auditors report I can surmise HDC were unprepared for the new IFRS accounting standards. Even though the Capital Accountant was ill and was subsequently made redundant this was a problem that HDC management should have managed. If there are not the right people to do the job then find someone who can. It is not as though the auditors just turned up unexpectedly. In the report the auditors state:

Following discussions with management following our appointment as external auditors we performed early audit work in February and March 2011 on the restatement of the prior year comparative information. At that time the evidence available to support the Council’s work to date on the IFRS conversion was not sufficient to enable us to carry out detailed audit procedures. We provided an assessment focussing on the key areas of the conversion and discussed this with Management in April 2011 who continued to work on the transition process.

So the Council's Management knew back in April 2011 there was trouble, though had an idea in February/March 2011. Yet as far as I can see the Management did little to resolve this situation so the accounts could be presented by the deadline of 30th September 2011.

In the report from the Auditors to the Council the following is said about the delay:

We therefore propose to include a report be exception following our vfm conclusion for 2010/11 to confirm that we have identified significant weaknesses in the Council’s arrangements for ensuring reliable and timely financial reporting that meets the needs of internal users, stakeholders and local people, as a result of the delay.

The report goes into detail:

However, the authority was not able to provide us with a comprehensive set of supporting working papers at the start of our audit. There are a number of reasons for this including:

- The Council’s capital accountant was absent on the grounds of ill health, and other finance staff had difficulty interpreting and understanding elements of capital accounting and capital financing information.

- The Council underestimated the level of resource required to do the IFRS restatements and produce the 2010/11 financial statements and the restated 2009/10 and 2008/09 information.

- As new auditors it was always expected that we would not have the same degree of knowledge of the specific circumstances of the Council as an incumbent, however, the Council underestimated the number of questions and supporting information that we would require to support the accounts.

This has had a knock on effect of our audit, resulting in working papers that did not agree to the accounts and significant gaps in the information provided to us, predominately in relation to capital accounting.

During the audit the finance team has on occasion, struggled to provide sufficient relevant and reliable information to us in respect of the Council’s leases, capital accounting and other elements of the accounts.

Yet the Capital accountant was one of those being made redundant!

The report still goes on:

As of 28 November 2011 we are still waiting on information from the Council to enable us to complete our audit. We will provide a full verbal update to the Panel when we meet with you on 7 December 2011.

During the audit the finance team has on occasion, struggled to provide sufficient relevant and reliable information to us in respect of the Council’s leases, capital accounting and other elements of the accounts.

Yet the Capital accountant was one of those being made redundant!

The report still goes on:

As of 28 November 2011 we are still waiting on information from the Council to enable us to complete our audit. We will provide a full verbal update to the Panel when we meet with you on 7 December 2011.

An interesting bit:

Leisure Centres

Our review of leases identified that the five leisure centres included on the Council’s balance sheet are held under management agreements. These agreements indicate that the assets are jointly controlled assets between the Council and Cambridgeshire County Council. The Council has prepared an assessment of the proportion of the assets attributable to the County Council based on capital investment in the assets since they were built. At the date of writing this report management were still in the process of making the necessary adjustments to the financial statements.

Initial calculations expect this to impact the cost of the assets on the balance sheet by decreasing their value by approximately £1.5 million - £2 million (£19.8 million total assets).

From the Auditors report I can surmise HDC were unprepared for the new IFRS accounting standards. Even though the Capital Accountant was ill and was subsequently made redundant this was a problem that HDC management should have managed. If there are not the right people to do the job then find someone who can. It is not as though the auditors just turned up unexpectedly. In the report the auditors state:

Following discussions with management following our appointment as external auditors we performed early audit work in February and March 2011 on the restatement of the prior year comparative information. At that time the evidence available to support the Council’s work to date on the IFRS conversion was not sufficient to enable us to carry out detailed audit procedures. We provided an assessment focussing on the key areas of the conversion and discussed this with Management in April 2011 who continued to work on the transition process.

So the Council's Management knew back in April 2011 there was trouble, though had an idea in February/March 2011. Yet as far as I can see the Management did little to resolve this situation so the accounts could be presented by the deadline of 30th September 2011.

Labels:

Breaking the Law,

HDC,

HDC Conservatives

Wednesday, November 30, 2011

Which one is lying? Cllr Ablewhite or The Hunts Post?

Further to a recent blog about Cllr Ablewhite and his 24% claim about the pension contributions to the local government pension scheme, I have received further information from the CAB which casts more doubt on the 24% claim reported in the Hunts Post as Cllr Ablewhite as saying the following:

"For example, 24 per cent of the money we give to the Citizens Advice Bureau goes into the local government pension scheme."

Hunts CAB says:

Either the Hunts Post is correct about what Cllr Ablewhite said or Cllr Ablewhite didn't say anything about the 24% and the Hunts Post is wrong. Either way when people look up why the CAB has had its grant cut then the reason will be 24% of the grant goes on pensions. This is rubbish.

"For example, 24 per cent of the money we give to the Citizens Advice Bureau goes into the local government pension scheme."

Hunts CAB says:

‘We have an employer’s contribution rate of 20.1% this financial year, and 22.1% for the financial year 2012-13 which will be the final year of the current SLA. The employer’s contribution rate only applies to the salaries of the three remaining active members of the scheme and we stopped admitting new members some years ago. This current year, the pension contributions represent 4.4 % of the budget allocated to us by HDC.’

Either the Hunts Post is correct about what Cllr Ablewhite said or Cllr Ablewhite didn't say anything about the 24% and the Hunts Post is wrong. Either way when people look up why the CAB has had its grant cut then the reason will be 24% of the grant goes on pensions. This is rubbish.

Labels:

CAB,

Cllr Abelwhite,

Hunts Post

Town Council council tax rate stays the same! Why?

The Conservatives have announced the Town Council tax rate will stay the same at £84.23 for a Band D property. This will be the third year running the Council Tax remains the same. So how do they do that when the new Conservative administration is spending money on HDC owned CCTV and South Street toilets?

The answer is the Liberal Democrats left the Town Councils finances in fine fettle. The Conservatives were welcomed with a £186,575 surplus on the 2010/11 budget when they took power. This leaves total reserves standing at £905,547 at the start of this financial year.

The Conservatives have had to face some cost increases:

The Town Council propaganda rag - Priorities - is costing an extra £10,534.

The money from HDC for the Customer Service Centre has gone - £7,084.

Museum running costs up by £4,000. Though they get this back in rent - up by £4,000.

Jubilee Hall is a new cost at £6,500. Though this is returned by rent increase to £6,500.

CCTV is a new cost at £22,750.

Grants has increased by £5,015.

Town Promotion salary £28,011.

QE2 celebration £20,000 - (a one off)

A total increase of £82,820.

With other savings and cuts this means the net expenditure for the Town Council section of the budget 2012/13 is £756,379. This is up from the 2011/12 budget (£705,373) by £53,988.

The reason why this increase isn't reflected in the Town is because a couple of costs have really gone down.

Eatons Community Centre down by £16,703.

Priory Centre costs are down saving £47,731

A total of £64,434 saved in the budget. This means the net expenditure before the capital cost is £820,957 against the 2011/12 budget of £831,406. This is a reduction of £10,449.

The problem is with the capital costs. These have been changed so the previous way of accounting for the in Earmarked Reserves (£398,134) which has been closed and the money transferred to the new Capital Projects account.

Capital Projects in 2011/12 were allocated £56,478 (This figure was £58,478 for last year. A £2,000 difference) For 2012/13 the allocation has gone up to £573,461. This is an increase of £514,983 (not £474,893 quoted in the draft budget). What has to be taken into account is the transferred money -£398,134. This makes an increase total of £116,849.

This is a big increase (though in reviews of previous Town Council budgets I reckoned the amount should be £100,000). £95,024 of this money is coming from General Reserves. Not usually good.

The precept for this year is £889,884. The precept for next year is £901,261. An extra £11,377. The money from extra housing is £11,371.

In the new capital budget there is money flying around everywhere.

Extra money is going into:

Allotment land - £38000

New cemetery land - £20000

Eatons Capital project - £10000

Loves Farm - £30000

Play areas - £10000

Signs - £2000

Toilets - £55000 (£40,000 capital + 1 year running costs £15,000)

Priory Centre - £40000

A total of £205,000

This was helped by:

Projects stopped - £29673

This leaves a net figure of an extra £175,327.

Of which £95,024 is coming from General reserves. The use of General reserves is a real no-no if this is used to reduce spending. The forecast is a budget surplus for 2011/12 of £94,540. If this is attained or exceeded then the funding isn't bad for next year.

The trouble is the underlying increase in capital spending. For instance if £40,000 for the toilets, £40,000 for the Priory Centre and £30,000 for Love's Farms are all one-offs and this money is taken from General Reserves the underlying increase is within reason.

A couple of problems:

1. The £15,000 a year to run the South Street Toilets isn't included in projections.

2. The Hall Hire income on Eatons Community Centre doesn't sit right.

The projected income for 2011/12 is £18,212. Next year there is roughly a £17k. Unless there is a good reason for this increase then adding £17k is wrong. By 2013/14 this rises by another £13k. This is a total increase of £30k over the projected figure for 2011/12.

The Town council could be out by £45,000 of extra expenditure in future years.

The Council Tax base has been announced. This now stands at 10,820 for next year. This is an increase of 120 over the 10,700 used in the calculations for the Council Tax. 120 x £84.23 = £10,170 in extra income not allowed for in the budget. If the Town Council just agreed the budget this would have made the Council Tax fall by 93 pence. (£901,261 / 10820 = £83.30). As the Town Council decided the amount of tax should be £84.23, the Town Council will see this money.

Overall this is a good first budget by the Conservatives. A few niggles on my part. Putting money aside for future projects, whilst they have the money, is a good thing for the Council. What helped most was the £186,575 surplus from the previous year when the Liberal Democrats were in power. For the future the Conservatives need to keep the budget balanced and tax & spend accordingly. Relying on reserves to keep the Town Council from raising Council Tax is a fool's errand.

The answer is the Liberal Democrats left the Town Councils finances in fine fettle. The Conservatives were welcomed with a £186,575 surplus on the 2010/11 budget when they took power. This leaves total reserves standing at £905,547 at the start of this financial year.

The Conservatives have had to face some cost increases:

The Town Council propaganda rag - Priorities - is costing an extra £10,534.

The money from HDC for the Customer Service Centre has gone - £7,084.

Museum running costs up by £4,000. Though they get this back in rent - up by £4,000.

Jubilee Hall is a new cost at £6,500. Though this is returned by rent increase to £6,500.

CCTV is a new cost at £22,750.

Grants has increased by £5,015.

Town Promotion salary £28,011.

QE2 celebration £20,000 - (a one off)

A total increase of £82,820.

With other savings and cuts this means the net expenditure for the Town Council section of the budget 2012/13 is £756,379. This is up from the 2011/12 budget (£705,373) by £53,988.

The reason why this increase isn't reflected in the Town is because a couple of costs have really gone down.

Eatons Community Centre down by £16,703.

Priory Centre costs are down saving £47,731

A total of £64,434 saved in the budget. This means the net expenditure before the capital cost is £820,957 against the 2011/12 budget of £831,406. This is a reduction of £10,449.

The problem is with the capital costs. These have been changed so the previous way of accounting for the in Earmarked Reserves (£398,134) which has been closed and the money transferred to the new Capital Projects account.

Capital Projects in 2011/12 were allocated £56,478 (This figure was £58,478 for last year. A £2,000 difference) For 2012/13 the allocation has gone up to £573,461. This is an increase of £514,983 (not £474,893 quoted in the draft budget). What has to be taken into account is the transferred money -£398,134. This makes an increase total of £116,849.

This is a big increase (though in reviews of previous Town Council budgets I reckoned the amount should be £100,000). £95,024 of this money is coming from General Reserves. Not usually good.

The precept for this year is £889,884. The precept for next year is £901,261. An extra £11,377. The money from extra housing is £11,371.

In the new capital budget there is money flying around everywhere.

Extra money is going into:

Allotment land - £38000

New cemetery land - £20000

Eatons Capital project - £10000

Loves Farm - £30000

Play areas - £10000

Signs - £2000

Toilets - £55000 (£40,000 capital + 1 year running costs £15,000)

Priory Centre - £40000

A total of £205,000

This was helped by:

Projects stopped - £29673

This leaves a net figure of an extra £175,327.

Of which £95,024 is coming from General reserves. The use of General reserves is a real no-no if this is used to reduce spending. The forecast is a budget surplus for 2011/12 of £94,540. If this is attained or exceeded then the funding isn't bad for next year.

The trouble is the underlying increase in capital spending. For instance if £40,000 for the toilets, £40,000 for the Priory Centre and £30,000 for Love's Farms are all one-offs and this money is taken from General Reserves the underlying increase is within reason.

A couple of problems:

1. The £15,000 a year to run the South Street Toilets isn't included in projections.

2. The Hall Hire income on Eatons Community Centre doesn't sit right.

The projected income for 2011/12 is £18,212. Next year there is roughly a £17k. Unless there is a good reason for this increase then adding £17k is wrong. By 2013/14 this rises by another £13k. This is a total increase of £30k over the projected figure for 2011/12.

The Town council could be out by £45,000 of extra expenditure in future years.

The Council Tax base has been announced. This now stands at 10,820 for next year. This is an increase of 120 over the 10,700 used in the calculations for the Council Tax. 120 x £84.23 = £10,170 in extra income not allowed for in the budget. If the Town Council just agreed the budget this would have made the Council Tax fall by 93 pence. (£901,261 / 10820 = £83.30). As the Town Council decided the amount of tax should be £84.23, the Town Council will see this money.

Overall this is a good first budget by the Conservatives. A few niggles on my part. Putting money aside for future projects, whilst they have the money, is a good thing for the Council. What helped most was the £186,575 surplus from the previous year when the Liberal Democrats were in power. For the future the Conservatives need to keep the budget balanced and tax & spend accordingly. Relying on reserves to keep the Town Council from raising Council Tax is a fool's errand.

Labels:

Conservatives,

SNTC

Where is the Conservative fund for Eynesbury Manor?

After the Conservatives annexed the the Town Ward of Eynesbury Hardwicke Parish (part of Parklands and most of Eynesbury Manor) to St Neots, the Conservatives went on the rampage blaming the Liberal Democrats. Yet this blog worked out the Conservatives pushed this annexation through.

Before the 2010 General Election the Conservatives put out a leaflet. In the last paragraph it says:

So under the new Conservative run Town Council this has all been forgotten. As the Conservatives said: "as you were expected to pay considerably more the money should be spent on Eynesbury."

Having said the above what are the Conservatives doing now they are in power? Nothing of course. No new money set aside specifically for the area. So none of the extra money coming in from the annexed area is specifically going to this area. In 2010/11Accounts, the Town Council receives £16,121 from its share of the abolition of Eynesbury Hardwicke PC. Was this money put aside? No. Did the incoming Conservatives put this money aside? No!

At the 2010 elections the Conservatives went to town on this subject. Once in power the Conservatives are silent on this subject. They have forgotten what they said.

Before the 2010 General Election the Conservatives put out a leaflet. In the last paragraph it says:

So under the new Conservative run Town Council this has all been forgotten. As the Conservatives said: "as you were expected to pay considerably more the money should be spent on Eynesbury."

Having said the above what are the Conservatives doing now they are in power? Nothing of course. No new money set aside specifically for the area. So none of the extra money coming in from the annexed area is specifically going to this area. In 2010/11Accounts, the Town Council receives £16,121 from its share of the abolition of Eynesbury Hardwicke PC. Was this money put aside? No. Did the incoming Conservatives put this money aside? No!

At the 2010 elections the Conservatives went to town on this subject. Once in power the Conservatives are silent on this subject. They have forgotten what they said.

Labels:

Annexed areas,

Conservatives,

EHPC

Tuesday, November 29, 2011

HDC still does not understand the New Homes Bonus

In the draft budget for 2012/13, the Conservative run Huntingdonshire District Council still doesn't get the reason for the New Homes Bonus (NHB). In the draft budget it says:

Members have expressed interest in the use of the Bonus. It is not ring-fenced for specific communities but there is ample evidence within this report that it will be used to enable the protection of services and for in investment in key growth areas.

The Government that pays the New Homes Bonus informs the public that HDC should be consulting with the communities which are accepting development on how the money should be spent. Yet HDC simply ignore this and carry on its merry way.

An Example:

Conservative controlled Wychavon District Council has been able to do a consultation and have a written policy toward their New Homes Bonus money. They even have loads of Parish Councils.

In the Wychavon policy it says:

(ii) Development in towns and villages

(a) Development within a Town or Parish area

Where development takes place in Droitwich Spa, Evesham, Pershore or the rural areas of the district, the Council will normally award up to 40% of the NHB accruing to be reinvested in the local community. This reward will not be ringfenced to any particular use but it must deliver ‘added value’ to the local community and area and where possible, benefit those communities close to any new development.

(b) Significant developments adjacent to towns

It is likely that some of the urban extensions to the three towns, which may be constructed over the next few years, may be delivered outside the administrative boundary of the town whilst clearly serving the growth of the urban area and reliant of amenities and services in the urban area.

The Council may determine that the NHB payments to be reinvested in local communities, in circumstances where it is serving urban growth, is split between the town and the rural parish(es) accommodating the urban growth. Of the allocation in (a) above, the split will normally be 80% to the town and 20% to the Parish.

In Wychavon up to 40% of New Homes Bonus money can go to the local community accepting this development. Not exactly what I would like to see. But it does go some way to meeting the needs of the Towns accepting developments.

The Wychavon NHB policy goes on:

9. Procedure for payment

1. The Council’s Executive Board will determine and authorise the release of any payments under the NHB scheme. The Council will publish on its website an annual statement of the NHB monies attributable to each town or parish area. Payments will generally be held until there is a commitment to spend the monies.

In a recent FOI request I was informed HDC cannot work out the New Homes Bonus attributable to St Neots. Yet Conservative run Wychavon will be doing so!

Before I get too carried away, there are difference between Wychavon DC and Huntingdonshire DC. These are:

Population: W=117,000 / H=167,300

Area: W=256.2 sq mi / H=352.3 sq mi

Density: W=456.7/sq mi / H=474.9/sq mi

Council Tax proposed for 2012/13: W= £108.44 (Zero increase) H=£127.17 (2.5% increase)

Even with a population density slightly lower, Conservative run Wychavon DC has a policy on New Homes Bonus and a lower Council Tax rate which isn't rising. In Huntingdonshire, we have a Conservative run Council with no real policy on New Homes Bonus, apart from denying its intended use, and is looking to put up the Council Tax.

Members have expressed interest in the use of the Bonus. It is not ring-fenced for specific communities but there is ample evidence within this report that it will be used to enable the protection of services and for in investment in key growth areas.

The Government that pays the New Homes Bonus informs the public that HDC should be consulting with the communities which are accepting development on how the money should be spent. Yet HDC simply ignore this and carry on its merry way.

An Example:

Conservative controlled Wychavon District Council has been able to do a consultation and have a written policy toward their New Homes Bonus money. They even have loads of Parish Councils.

In the Wychavon policy it says:

(ii) Development in towns and villages

(a) Development within a Town or Parish area

Where development takes place in Droitwich Spa, Evesham, Pershore or the rural areas of the district, the Council will normally award up to 40% of the NHB accruing to be reinvested in the local community. This reward will not be ringfenced to any particular use but it must deliver ‘added value’ to the local community and area and where possible, benefit those communities close to any new development.

(b) Significant developments adjacent to towns

It is likely that some of the urban extensions to the three towns, which may be constructed over the next few years, may be delivered outside the administrative boundary of the town whilst clearly serving the growth of the urban area and reliant of amenities and services in the urban area.

The Council may determine that the NHB payments to be reinvested in local communities, in circumstances where it is serving urban growth, is split between the town and the rural parish(es) accommodating the urban growth. Of the allocation in (a) above, the split will normally be 80% to the town and 20% to the Parish.

In Wychavon up to 40% of New Homes Bonus money can go to the local community accepting this development. Not exactly what I would like to see. But it does go some way to meeting the needs of the Towns accepting developments.

The Wychavon NHB policy goes on:

9. Procedure for payment

1. The Council’s Executive Board will determine and authorise the release of any payments under the NHB scheme. The Council will publish on its website an annual statement of the NHB monies attributable to each town or parish area. Payments will generally be held until there is a commitment to spend the monies.

In a recent FOI request I was informed HDC cannot work out the New Homes Bonus attributable to St Neots. Yet Conservative run Wychavon will be doing so!

Before I get too carried away, there are difference between Wychavon DC and Huntingdonshire DC. These are:

Population: W=117,000 / H=167,300

Area: W=256.2 sq mi / H=352.3 sq mi

Density: W=456.7/sq mi / H=474.9/sq mi

Council Tax proposed for 2012/13: W= £108.44 (Zero increase) H=£127.17 (2.5% increase)

Even with a population density slightly lower, Conservative run Wychavon DC has a policy on New Homes Bonus and a lower Council Tax rate which isn't rising. In Huntingdonshire, we have a Conservative run Council with no real policy on New Homes Bonus, apart from denying its intended use, and is looking to put up the Council Tax.

Labels:

Conservatives,

HDC,

New Homes Bonus

Sunday, November 27, 2011

HDC changes tune of South Street Toilets

Conservative run Town Council has put £55,000 for the refurbishment of South Street Public Toilets closed by HDC because they wanted to knock them down and build flats. The reasons given were:

3. TOILETS AT SOUTH STREET, ST NEOTS

3.1 It is generally acknowledged that, of the existing stock of town centre public conveniences, the facilities at South Street, St Neots, are the least effective both in terms of the quality of provision and their fit with adjoining land uses. Their location is shown on the plan at Annex A.

3.2 In recent years, property in the vicinity of the public convenience has been or is being converted to residential use and the quality of the buildings upgraded. The public convenience now is detracting from the amenity of the area.

This has been a theme of HDC. In 2006 the South Street Toilets were described as thus:

"Furthermore the setting is considered inappropriate in the context of adjacent redevelopment and the demolition of the site is recommended."

"The Panel were apprised of the poor condition of the public conveniences and their inappropriate location in a conservation area."

HDC believes these toilets are inappropriate for South Street and inappropriate for a Conservation Area. Yet HDC is looking to allow SNTC to refurbish and re-open these toilets even though HDC believes Public Toilets are inappropriate in this area.

Which is it HDC? Does HDC believe these public toilets are inappropriate or are they now appropriate because the idea of demolishing them and building flats didn't even take off?

The trouble is I can't believe reasons HDC give for decisions because they change according to the decision HDC wants. If these toilets are inappropriate then do something else with them rather than allowing an inappropriate use!

3. TOILETS AT SOUTH STREET, ST NEOTS

3.1 It is generally acknowledged that, of the existing stock of town centre public conveniences, the facilities at South Street, St Neots, are the least effective both in terms of the quality of provision and their fit with adjoining land uses. Their location is shown on the plan at Annex A.

3.2 In recent years, property in the vicinity of the public convenience has been or is being converted to residential use and the quality of the buildings upgraded. The public convenience now is detracting from the amenity of the area.

This has been a theme of HDC. In 2006 the South Street Toilets were described as thus:

"Furthermore the setting is considered inappropriate in the context of adjacent redevelopment and the demolition of the site is recommended."

"The Panel were apprised of the poor condition of the public conveniences and their inappropriate location in a conservation area."

HDC believes these toilets are inappropriate for South Street and inappropriate for a Conservation Area. Yet HDC is looking to allow SNTC to refurbish and re-open these toilets even though HDC believes Public Toilets are inappropriate in this area.

Which is it HDC? Does HDC believe these public toilets are inappropriate or are they now appropriate because the idea of demolishing them and building flats didn't even take off?

The trouble is I can't believe reasons HDC give for decisions because they change according to the decision HDC wants. If these toilets are inappropriate then do something else with them rather than allowing an inappropriate use!

Labels:

HDC lies

Thursday, November 24, 2011

Conservative run HDC doesn't take Osborne's money

In the initial draft budget the Conservative run HDC is NOT taking the money made available for another year of freezing Council Tax. Events may change, but as first pointed out on this blog, the Osborne money to freeze the Council Tax for a year will mean cuts in future years. Something the Conservatives don't seem to want to do.

This very Conservative run Council seems to be saying NO to George Osborne.

Labels:

Conservatives,

Council Tax Freeze,

HDC,

HDC Budget 2012/13

Friday, November 18, 2011

Are our District Councillors attending meetings?

I took a quick look at the attendance records of St Neots District Councillors at meetings from the HDC website and the results are:

1st. Andrew Hansard: 100%

2nd. Barry Chapman: 86%

3rd. Paula Longford: 75%

4th. Roger Harrison: 75%

5th. Steve van de Kerkhove: 73%

6th. Rodney Farrer: 71%

7th. David Harty: 71%

8th. Andrew Jennings: 67%

and last of all lagging behind the rest is.....

9th. Paul Ursell: 50%

1st. Andrew Hansard: 100%

2nd. Barry Chapman: 86%

3rd. Paula Longford: 75%

4th. Roger Harrison: 75%

5th. Steve van de Kerkhove: 73%

6th. Rodney Farrer: 71%

7th. David Harty: 71%

8th. Andrew Jennings: 67%

and last of all lagging behind the rest is.....

9th. Paul Ursell: 50%

Labels:

Councillors

Wednesday, November 16, 2011

Should we take what Cllr Ablewhite says on face value?

In a recent article in the Hunts Post, Cllr Ablewhite, Council Leader, informs readers how in his reign HDC is saving money.

This is one of his musings:

The total pension costs shown is £11,237 or 6% of the £183,250 granted by HDC. That is £32,743 short of the total. HDC;s current rate of pension contributions is at 20.4% for employees in the pension scheme. Even at that high rate £11,237 represents £55,083 pensionable earnings of £119,537 in HCAB wages. So not all employees are members of the pensions scheme.

If all wages and salaries are in the local government pension scheme (and they aren't) then the employees contribution would have to be 17.9%. Now these employees aren't getting large salaries so they can't pay this much in pension contributions. On the LGPS website the contributions are given and they average out at 6%.

So the employee contributions at 6% would be roughly £11,237.

So adding together what the employees pay and HCAB pays this adds up to £22,474. This is still £21,416 short of the £43,980 that Cllr Ablewhite says is the 24%.

The 24% figure is wrong. 24% doesn't go to the LGPS from HCAB even if employee contributions added in.

And another:

“As part of that process we have reviewed CCTV and can keep some of that.”

The Hunts Post goes onto explain...

"HDC is hoping to attract funding from town councils in Huntingdonshire where the coverage is concentrated,"

Yes all this means is the Town Council taxpayer gets charged for this instead of HDC. If HDC is going down the differential charging route then Town taxpayers should see a discount on rubbish collection because it is cost effective to deliver this service in a Town and very cost ineffective to deliver this service in rural locations. Will rural dwellers be paying more for their bins to be collected? No they won't!

And the Conservative cheerleader that is the Hunts Post also does its bit for misinformation with this:

A year ago residents were facing HDC having to cut more than 120 jobs, ditch its CCTV surveillance scheme, double parking charges and cut the opening hours of its call centre and leisure centres, and a reduction from £485,000 a year to just £85,000 in funding for charities, as it tried to deal with the large hole left in its budget by the coalition Government’s cuts.

Yet many of these cuts were envisioned before the Coalition cuts came in. HDC had a massive deficit problem and was running out of reserves. This is main reason behind the cuts. Yes, the Coalition added to this but HDC and their cheerleader the Hunts Post hide behind the false premise.

Also in the article is the following:

"And while the Council Tax precept was frozen in April, residents faced the prospect that it could rise by nearly 20 per cent in April 2012."

Only if there was a referendum!

The answer to the original question: "Should we take what Cllr Ablewhite says on face value?", the answer is NO. The 24% figure is wildly wrong and gives a totally false impression of where the funding goes.

What Cllr Ablewhite should be talking about is how the New Homes Bonus nicked from St Neots et al is currently propping up a failing budget. And the Hunts Post should be looking into the finances and why cuts are necessary rather than doing puff pieces as a cheerleader. It doesn't even look into why HDC's own accounts are late.

This is one of his musings:

“More and more over the years we have seen the council funding employment rather than volunteers. For example, 24 per cent of the money we give to the Citizens Advice Bureau goes into the local government pension scheme. So we need the voluntary organisations to make the efficiency savings that they can to save us money over the longer term.”

Hmm... Yes HDC is funding employees rather than volunteers. Yes they have a pension pot. But does his figures add up? Well no they don't. The accounts for Huntingdonshire Citizens Advice Bureau are here. They show that HDC granted HCAB £183,500. 24% of £183,250 = £43,980.The total pension costs shown is £11,237 or 6% of the £183,250 granted by HDC. That is £32,743 short of the total. HDC;s current rate of pension contributions is at 20.4% for employees in the pension scheme. Even at that high rate £11,237 represents £55,083 pensionable earnings of £119,537 in HCAB wages. So not all employees are members of the pensions scheme.

If all wages and salaries are in the local government pension scheme (and they aren't) then the employees contribution would have to be 17.9%. Now these employees aren't getting large salaries so they can't pay this much in pension contributions. On the LGPS website the contributions are given and they average out at 6%.

So the employee contributions at 6% would be roughly £11,237.

So adding together what the employees pay and HCAB pays this adds up to £22,474. This is still £21,416 short of the £43,980 that Cllr Ablewhite says is the 24%.

The 24% figure is wrong. 24% doesn't go to the LGPS from HCAB even if employee contributions added in.

And another:

“As part of that process we have reviewed CCTV and can keep some of that.”

The Hunts Post goes onto explain...

"HDC is hoping to attract funding from town councils in Huntingdonshire where the coverage is concentrated,"

Yes all this means is the Town Council taxpayer gets charged for this instead of HDC. If HDC is going down the differential charging route then Town taxpayers should see a discount on rubbish collection because it is cost effective to deliver this service in a Town and very cost ineffective to deliver this service in rural locations. Will rural dwellers be paying more for their bins to be collected? No they won't!

And the Conservative cheerleader that is the Hunts Post also does its bit for misinformation with this:

A year ago residents were facing HDC having to cut more than 120 jobs, ditch its CCTV surveillance scheme, double parking charges and cut the opening hours of its call centre and leisure centres, and a reduction from £485,000 a year to just £85,000 in funding for charities, as it tried to deal with the large hole left in its budget by the coalition Government’s cuts.

Yet many of these cuts were envisioned before the Coalition cuts came in. HDC had a massive deficit problem and was running out of reserves. This is main reason behind the cuts. Yes, the Coalition added to this but HDC and their cheerleader the Hunts Post hide behind the false premise.

Also in the article is the following:

"And while the Council Tax precept was frozen in April, residents faced the prospect that it could rise by nearly 20 per cent in April 2012."

Only if there was a referendum!

The answer to the original question: "Should we take what Cllr Ablewhite says on face value?", the answer is NO. The 24% figure is wildly wrong and gives a totally false impression of where the funding goes.

What Cllr Ablewhite should be talking about is how the New Homes Bonus nicked from St Neots et al is currently propping up a failing budget. And the Hunts Post should be looking into the finances and why cuts are necessary rather than doing puff pieces as a cheerleader. It doesn't even look into why HDC's own accounts are late.

Labels:

Cllr Ablewhite,

Conservatives,

HDC,

Hunts Post

Tuesday, November 15, 2011

Lets Tax and Spend

Now I'm a tax and spend person. I believe that Government at all levels should tax and spend. What I mean by tax and spend is Government should determine what services it needs and wants to provide and at what service level and then tax accordingly. If our politicians don't like the level of tax then they go back to what services they want to provide. I know Government finances are more complicated than this simple principle, yet if Government and Council follow this simple principle we get the price of services and can decide what we want to be taxed.

Council Tax is the local tax for local services. In Cambridgeshire most of the money goes to the County Council, with some going to District and some going to the Town and Parish Councils.

Use of reserves is one of the biggest problems that distorts the Council Tax rates. Because it gives the impression that services are being paid for out of Council Tax and by using reserves to keep Council Tax down this gives a false impression of services costing less than they actually do.

The problem is compounded because of inflation.

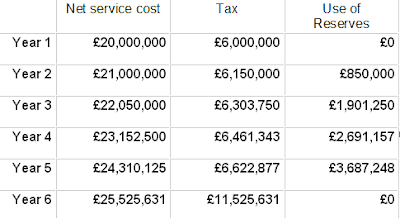

Below is a simple example of using reserves to keep the cost of council tax down. In this example a £1,000,000 of reserves are used with a 10% increase in the net cost of services and Council Tax is kept at zero increase.

In Year 6 reserves have run out and the options are to either raise Council Tax by 50% or cut £500,000 from the net cost of services.

In the next example the amount of increase is 2.5% in the net cost of services and 2.5% increase in the Council Tax. This example assumes no increase in Government Grant or charges the Council can make which makes up the £14,000,000 difference between the Net service cost and Tax.

So having spent £3,588,600 in reserves, in Year 6 there is a deficit of £1,839,715. To make this up Council tax would have to rise by 30% in Year 6 to make up this deficit.

In the next example the Net Cost of Services rises by 5% and the Council Tax increases by 2.5%. As in the previous example Government grants and service charges have a zero increase.

The deficit in Year 6 is £4,737,182. This added to the Council Tax would mean a 69.7% rise on top of the 2.5% annual rise. Either the Council Tax goes up by 69.7% or the Net service cost has to be cut £4,737,182.

Over just 4 years the amount of Reserves spent is £9,129,655.

I know there are many other factors in the actual calculations with Government grants which do go up but are currently reducing. I know charges haven't been included, but charging for services is a double edged sword as pushing up charges can mean a loss of revenue as people may not be willing to pay higher charges. But this isn't the point of these examples. What I'm trying to show is using reserves to keep Council Tax down by using reserves is false and is wrong. The cost of services are not reflected in the amount of Council Tax increases and there comes a time when either Council Tax has to rise or services are cut and the same amount of Council Tax has to be paid.

Both the Town Council and the District Council have kept Council Tax down by using reserves. Under the Liberal Democrats, the Town Council eventually ran out of reserves and had to cut projects to maintain a low Council Tax rise. The same goes for HDC which had the problem of using reserves to keep services going in its "socialist utopia". The deficit caused by low tax/high services is being slowly dealt with by cuts. What HDC needed to decide is whether it wants to be a high tax/high services council or a low tax/low services council. I feel they have decided to be neither.

In the coming budget round it will be interesting to see what the Town and District Councils will do with the spending pressures they are accumulating. The capping regime has gone and authorities can put up their portions that make up the Council Tax by whatever they like so long as it is approved by a referendum. The Zero Council Tax bribe by George Osbourne is also going to cause problems as this too makes a problem for the future as I does exactly what using reserves does. It will give a false impression on what the Council Tax rate should be. Also it HDC get £200,000 in extra grant this year without this money next year it will mean a greater rise in Council Tax or more cuts.

Council Tax is the local tax for local services. In Cambridgeshire most of the money goes to the County Council, with some going to District and some going to the Town and Parish Councils.

Use of reserves is one of the biggest problems that distorts the Council Tax rates. Because it gives the impression that services are being paid for out of Council Tax and by using reserves to keep Council Tax down this gives a false impression of services costing less than they actually do.

The problem is compounded because of inflation.

Below is a simple example of using reserves to keep the cost of council tax down. In this example a £1,000,000 of reserves are used with a 10% increase in the net cost of services and Council Tax is kept at zero increase.

In Year 6 reserves have run out and the options are to either raise Council Tax by 50% or cut £500,000 from the net cost of services.

In the next example the amount of increase is 2.5% in the net cost of services and 2.5% increase in the Council Tax. This example assumes no increase in Government Grant or charges the Council can make which makes up the £14,000,000 difference between the Net service cost and Tax.

So having spent £3,588,600 in reserves, in Year 6 there is a deficit of £1,839,715. To make this up Council tax would have to rise by 30% in Year 6 to make up this deficit.

In the next example the Net Cost of Services rises by 5% and the Council Tax increases by 2.5%. As in the previous example Government grants and service charges have a zero increase.